In 2024, over 4,100 publicly disclosed data breaches occurred - that’s about 11 breaches a day. And with the cost of breaches rising to about $4.4 million per breach, according to the IBM Cost of a Data Breach 2025 Report, planning a robust cybersecurity strategy and investment plan is crucial to your organization's success.

As organizations move through 2025 and begin planning for 2026, cyber leaders face a new budgeting reality: threat velocity is increasing, regulations are tightening globally, digital transformation is accelerating, and boards are demanding financial clarity and measurable risk reduction.

Cyber budgets are no longer just about tools and headcount; they are becoming strategic investments in resilience, business continuity, and quantifiable risk reduction. Organizations need cybersecurity strategies that are dynamic, data-driven, and aligned to business outcomes, not static annual spending plans.

This is where the shift toward connected, continuous, and quantified cyber risk management becomes the defining budgeting theme for 2026.

The New Imperative: A Cybersecurity Budget Strategy Built on Risk, Not Checkboxes

A modern cybersecurity budget can no longer be a patchwork of point solutions, siloed tools, and manual spreadsheet-driven processes. Today’s leaders must fund strategies that unify security, risk, and compliance under a single risk-first framework.

This shift is being driven by:

- Escalating regulatory pressure (NIST CSF 2.0, DORA, NIS 2, state privacy laws)

- The rising cost of breaches, from downtime and data loss to legal and reputational impact

- Board-level expectations for cyber risk quantification and financial reporting

- Operational strain from growing control sets, audits, and vendor ecosystems

Cyber budgeting in 2026 is about answering the question:

“How can we make cyber investments that reduce measurable risk, accelerate compliance, and improve operational efficiency, while proving ROI to the business?”

This is the strategic shift CyberSaint has been leading: moving organizations from reactive spending to risk-optimized investment supported by real-time posture and quantifiable insights.

How Cyber Leaders Should Right-Size Their Budgets in 2026

1. Budgeting by Company Size and Complexity

Large Enterprises (1,000+ employees)

Enterprises are increasingly consolidating legacy, duplicative, and disconnected tools under a unified Cyber GRC and cyber risk management platform. They are prioritizing:

- Continuous compliance automation (telemetry-driven validation)

- Enterprise-wide risk register centralization

- CRQ for board reporting and budget justification

- Evidence automation and audit readiness

- End-to-end mapping across NIST, ISO, CIS, PCI, and custom frameworks

Mid-Market Organizations (100–1,000 employees)

Mid-market teams face resource strain and rely on:

- Automated crosswalking and control mapping

- AI-supported assessment workflows

- Consolidated risk and compliance management to avoid tool sprawl

- Scenario modeling to prioritize investments with the highest risk reduction

Small Organizations (<100 employees)

Smaller teams need cost-efficient, scalable approaches focused on:

- Foundational control effectiveness validation

- Framework alignment (NIST CSF, CIS)

- High-impact automation to reduce manual work

- MSSP/consultant augmentation, especially when integrated through a unified platform

2. Budgeting for Industry-Specific Risk and Regulatory Pressure

Every sector now faces mounting regulatory scrutiny, but industries such as healthcare, finance, government, and critical infrastructure face heightened risk exposure and rising non-compliance costs.

CyberSaint’s Predictions 2026 research identifies three major cross-industry themes:

- Regulation will outpace manual processes, driving a pivot to automated compliance and audit readiness.

- Boards will require quantifiable cyber risk assessments, forcing CISOs to adopt CRQ frameworks such as FAIR and NIST 800-30.

- Attackers exploit operational blind spots, pushing organizations to adopt continuous control monitoring (CCM) and automated real-time evidence collection.

These trends shape budgeting priorities for 2026:

- Healthcare: NIST CSF 2.0 + HIPAA alignment, medical device risk, legacy system exposure

- Financial Services: DORA, NYDFS 500, continuous control validation

- Government/Public Sector: Zero Trust readiness, FedRAMP High, evidence automation

- Manufacturing/OT: IoT and OT system risk quantification, supply chain exposure

Organizations that budget for dynamic, risk-driven compliance rather than annual checklists will see the greatest reductions in both costs and vulnerabilities.

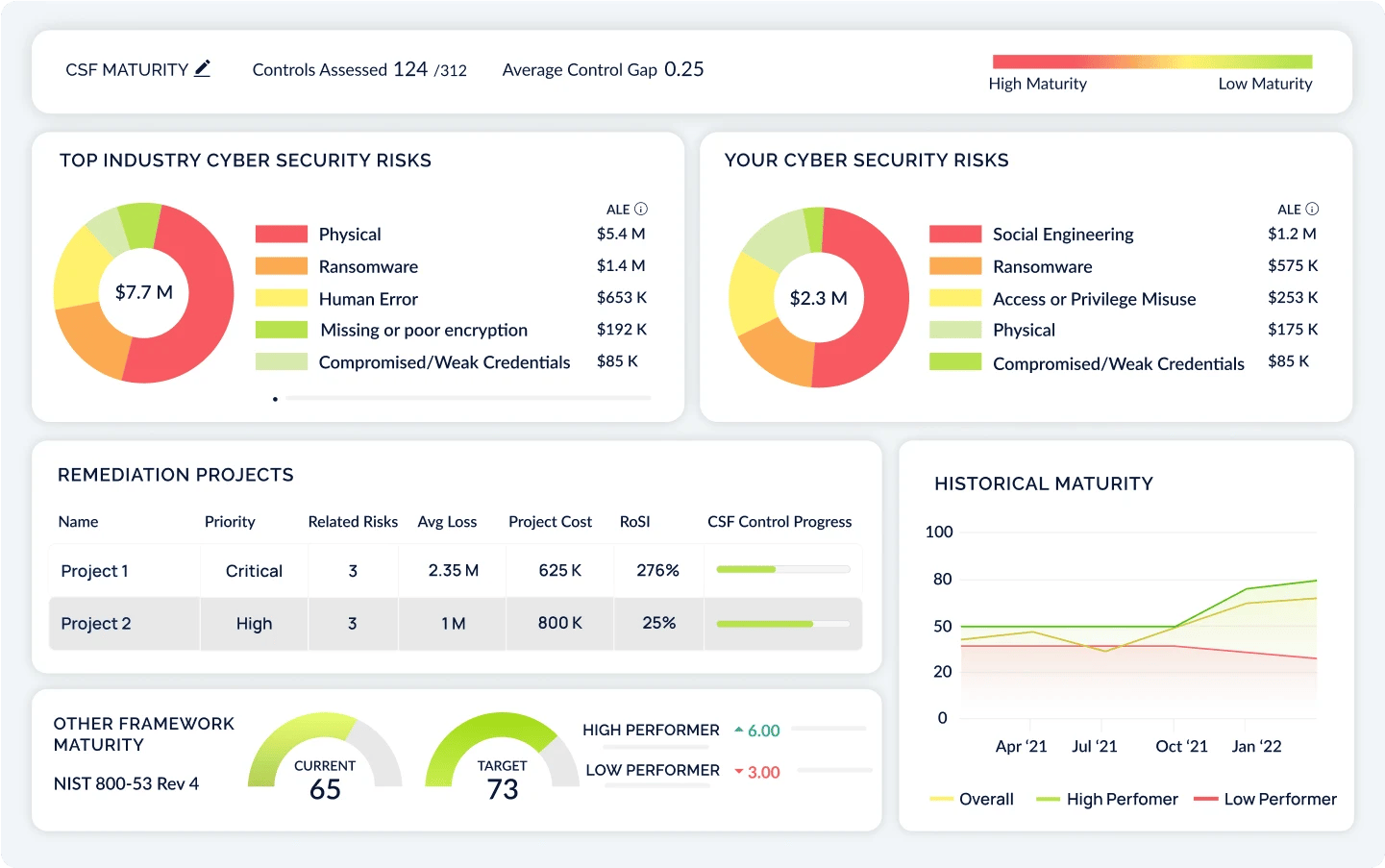

3. Budgeting Based on Risk Profile and Control Maturity

A key budgeting shift in 2026 is moving away from assumptions and toward real-time, data-backed risk posture.

High-risk organizations, those with distributed workforces, complex vendor ecosystems, cloud sprawl, or IoT/OT exposure, must invest in:

- Continuous compliance automation (CCA)

- Attack surface correlation with control data

- Scenario modeling and cyber risk quantification

- Third-party risk management automation

Lower-risk organizations can still maximize ROI by prioritizing:

- Core risk and compliance workflows

- Foundational controls validation

- Simplified reporting and executive dashboards

The budget conversation is no longer: "How much are we spending?"

It’s now: "What risk reduction are we buying for every dollar spent?"

This is why CyberSaint’s CRQ and risk-based dashboards have become essential budget tools for CISOs.

4. Budgeting for Compliance and Audit Efficiency

Compliance is one of the largest hidden cost centers in cyber budgets. In 2026, organizations are allocating significant budget toward:

- Evidence automation

- Real-time audit readiness

- Automated control mapping

- Elimination of duplicative assessments

- Continuous readiness across all frameworks

Manual compliance accounts for 60–70% of annual cyber labor hours, creates duplicate effort across teams, frameworks, and audits, and results in millions in lost productivity.

CyberStrong replaces these manual workflows with AI-powered intent-based control mapping, automated evidence collection, framework crosswalking, and continuous risk assessments. This shifts compliance from a cost center to an automated, always-on business function.

CyberSaint’s Budgeting Benchmarks for 2026

Connected. Continuous. Quantified.

Based on CyberSaint’s predictions for 2026 themes and what we’re seeing across enterprise Cyber GRC, TPRM, and CCM maturity, the most effective organizations are shifting their budgets in four major ways:

1. A Major Budget Shift From Point Tools to Platform Consolidation

Organizations are reallocating a significant share of their existing tool spend away from:

- Fragmented GRC tools

- Siloed assessment platforms

- Vendor-specific control validation products

- Manual audit tooling

- Isolated CRQ or VRM solutions

…toward platform consolidation that replaces multiple legacy tools with one connected system.

Lower operational overhead, fewer integration and maintenance costs, the elimination of duplicate assessments, and unified reporting with shared data models drive this shift.

CyberSaint Trend:

Organizations are directing a growing share of their budgets toward unified Cyber GRC, CRQ, and CCM platforms that deliver visibility across the entire risk lifecycle.

2. Increasing Investment in Automation Across the Cyber Lifecycle

Organizations intentionally prioritize automation capabilities such as:

- AI-powered control mapping

- Agentic evidence collection

- Continuous control automation (CCA)

- Model-agnostic CRQ

- Remediation modeling supported with workflow automation

CyberSaint Trend:

Automation is quickly becoming a top-three budget priority, because it eliminates thousands of manual hours and dramatically accelerates compliance cycles.

3. Higher Allocation Toward Quantification and Decision Intelligence

Budgets are increasingly directed toward technologies that deliver measurable, defensible risk insights:

- FAIR and NIST 800-30 CRQ

- Loss scenario modeling

- Risk-based investment planning

- Peer benchmarking

CyberSaint Trend:

CRQ has become a foundational budgeting requirement, used to justify spending, communicate with the board, and optimize resource allocation.

4. Reinvestment Into Continuous Testing and Real-Time Assurance

Instead of budgeting for annual point-in-time validation, organizations are shifting their spending toward continuous compliance readiness, telemetry-driven control effectiveness scoring, automated third-party risk assurance, and ongoing attack surface and posture correlation.

CyberSaint Trend:

Continuous assurance is becoming a core operating expense, driven by regulatory pressure and board-level visibility expectations.

The 2026 Cyber Budget Belongs to Organizations That Are Connected, Continuous, and Quantified

2026 marks a turning point in how organizations think about cybersecurity investments. The most resilient and cost-efficient organizations are not the ones spending the most, they are the ones spending strategically.

The winners in 2026 will be the organizations that:

- Connect their risk, compliance, and security data into a unified risk model

- Continuously validate control effectiveness and audit readiness, rather than relying on annual snapshots

- Quantify cyber risk in financial terms to justify investment, defend spend, and guide security strategy

CyberSaint’s platform is designed around this new reality. By unifying automation, CRQ, continuous controls, and compliance intelligence, CyberStrong helps organizations make budgeting decisions rooted in real-time data, measurable risk reduction, and operational efficiency, not guesswork or static spreadsheets.

Organizations that adopt this connected, continuous, and quantified approach will enter 2026 with stronger resilience, clearer business alignment, and a more defensible, optimized cybersecurity budget.

.png)

.png)

.png)

%201.png)

.png)