Cyber threats in the financial sector are ever-changing and constantly evolving with the digitization of financial systems. Information Security professionals have varying perspectives on how to approach securing their financial institutions. One thing, however, remains clear: consumers and businesses trust financial institutions to secure their capital and livelihood. Therefore, your reputation as a stakeholder in a business in this sector must give a transparent and direct view into an ultra-secure cyber compliance methodology.

The Financial Services sector holds immense amounts of sensitive data, from check routing information, stock data, investment information, and calculations, as well as personally identifiable information. Losing this sensitive data and financial information to malicious cyber attackers has affected banks' and others' reputations in the past and the future.

How FinServe InfoSec Execs Approach Cyber Security & Compliance

The Financial Services Information Sharing and Analysis Center (FS-ISAC) found that employee training was in top priority, likely because of the low cost and high return nature of a thorough and effective training program. Infrastructure upgrades and network defense initiatives are also named as top priorities by 25% of respondents, and then breach prevention (17%), according to the study.

The FS-ISAC encourages frequent reporting to the Board of Directors to make sure that businesses maintain a cybersecurity risk posture that's ready for executive or board review. The issue for many organizations is coming up with risk and cyber security compliance reports that thoroughly and simply explain the posture, gaps, and remediation plans of the infosec team to non-infosec stakeholders.

The Use of Cyber Standards in Financial Institutions

Governance, risk, and compliance frameworks created by industry experts resulted in FFIEC, PCI DSS, ISO, GLBA, ISACA, 23 NYCRR part 500, and others all wanting to assess organizations' cybersecurity strengths and weaknesses in order to identify compliance gaps and give insight into where an organization might start to remediate in order to build cyber strength. Regulators have rolled out privacy and security regulatory compliance standards like the General Data Protection Regulation (GDPR) to raise the standard for data security.

Compliance standards in the space, however, don't give visibility into your cyber risk posture based on the depth and breadth that is required to run a genuinely sophisticated data security program. Risk assessments are labor-intensive, resource-constrained, and mostly run via static spreadsheets.

This is why over 3,000 industry professionals came together to create the NIST Cybersecurity Framework, a voluntary framework that pulls a clear, actionable, and visible framework together out of the NIST 800-53 set of security controls, giving you the most depth and breadth available to assess your program on.

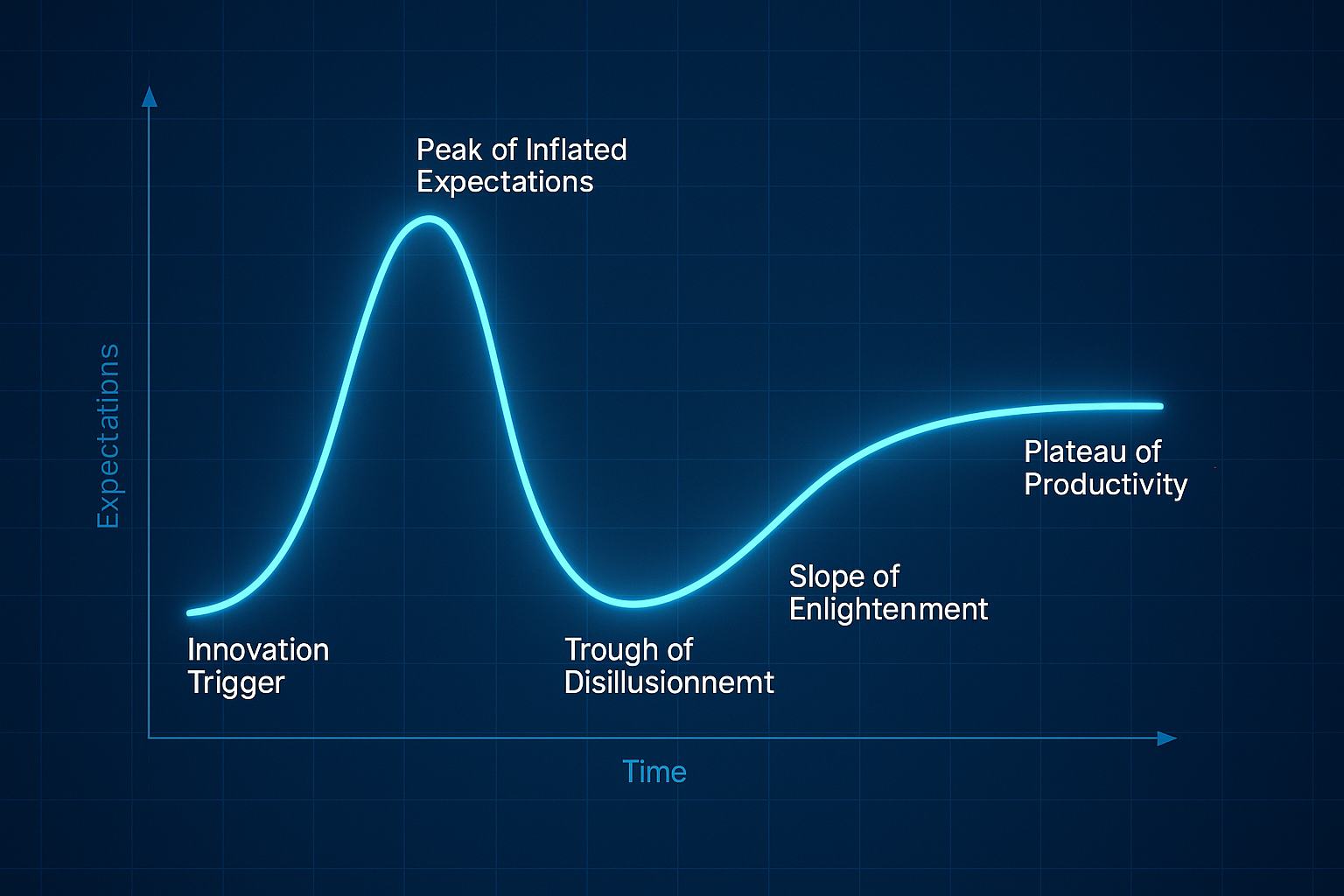

NIST Cybersecurity Framework Implementation is Skyrocketing... but Not Every Firm Can Handle All These Regulations at Once!

The National Institute of Standards and Technology published an article in 2016, toting the statistic that just 2 years ago, 30% of U.S. organizations. As cyber security financial industry threats are increasing, NIST writes that the framework operates as a "Rosetta Stone," translating sector-specific risk management language.

A report by the Financial Services Sector Coordinating Council (FSSCC) reported that this "Rosetta Stone" NIST Framework "creates a common understanding amongst the sectors around various risk management terms and phrases." According to Financial Services leaders, the clout of NIST's Cybersecurity Framework for Financial Institutions is unparalleled.

The issue with the idea of implementing NIST best practices is that it sounds like a great idea, but firms have other regulatory requirements that they must prioritize. Many of these regs are difficult to not only comply with but also to prove and report on -- not to mention to monitor and update continuously.

Achieve cybersecurity compliance in the financial sector with an automated platform like CyberStrong. Download the CyberStrong Solution Sheet to learn how CyberStrong streamlines your cybersecurity compliance program, maps all your controls to NIST best practices, and gives clear insight into your NIST 800-30 risk posture for each control.

.png)

.png)

.png)

%201.png)

.png)